Homebuilder stocks surged this week on reports of a proposed “Trump Homes” housing policy. Major players like Lennar and Taylor Morrison led gains amid talks of building up to 1 million affordable homes.

Stock Market Reaction

Homebuilder stocks jumped sharply after Bloomberg reported builders pitching a “Trump Homes” plan to the Trump administration. Lennar (LEN) shares rose over 5% on Wednesday, building on a 3% gain on Tuesday, while Taylor Morrison (TMHC) climbed more than 3% both days.

D.R. Horton (DHI) and PulteGroup (PHM) saw gains near 3%, even as the S&P 500 dipped. The iShares U.S. Home Construction ETF (ITB) spiked 4.9%, reflecting broad sector optimism on Trump’s home policy plays.

KB Home (KBH) also advanced, bucking wider market declines. These moves tie directly to affordability-focused proposals amid U.S. housing shortages.

Trump Homes Proposal Details

Builders, including Lennar and Taylor Morrison, are developing a privately funded “Trump Homes” initiative for entry-level houses. The plan targets first-time buyers through a rent-to-own model, in which tenants apply three years of rent toward down payments.

It could deliver up to 1 million homes, valued at over $250 billion, sold to private investors who manage rentals. Discussions began last year, but details such as federal mortgage backing remain unclear.

This aligns with Trump’s broader 2026 housing push, including deregulation and 50-year mortgages to cut payments. Treasury Secretary Scott Bessent floated a national housing emergency to standardize codes and ease tariffs on materials.

Key Homebuilder Players

Lennar and Taylor Morrison spearhead the pitch, positioning for massive scale in Trump’s housing policy. D.R. Horton, the largest U.S. builder, benefits from potential supply boosts despite past buyback scrutiny.

PulteGroup and KB Home ride the wave amid policy hype, with stocks up. These firms eye rent-to-own as a fix for inventory shortages, driving high prices.

Policy Context

Trump’s early executive orders prioritize housing supply by slashing regulations, earning praise from the National Association of Home Builders. The admin targets institutional investors buying single-family homes to free inventory.

Bipartisan bills aim to streamline approvals and raise multifamily loan limits. Yet, mortgage rates above 6% persist, complicating affordability.

Challenges Ahead

Implementation hurdles loom for Trump Homes, including investor risk and federal involvement. One source called the rent-to-own setup “complicated,” with no formal plan yet confirmed.

Tariffs on Canada and Mexico could raise material costs, offsetting gains. Critics note that longer mortgages, such as 50-year terms, might inflate total debt.

Market Outlook

Homebuilder stocks signal investor bets that Trump’s housing policy will unlock supply. If realized, 1 million units could ease shortages, but execution risks linger.

This proposal smartly leverages private capital over taxpayer funds, a pragmatic shift from past subsidies. Yet builders must prioritize true affordability, entry-level homes under $300,000 in high-cost areas, or risk becoming branded as hype without impact. Watch mid-2026 for pilot projects; success here could redefine homebuilder dominance in a deregulated market.

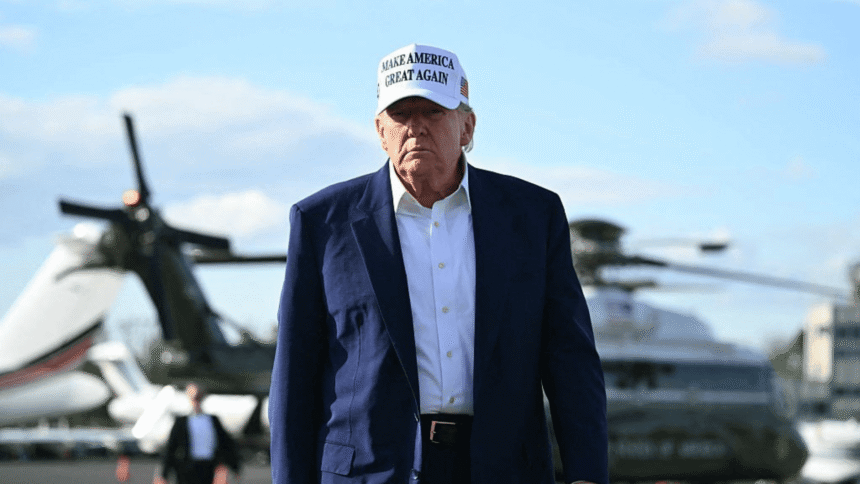

Getty Images/ SAUL LOEB