Raleigh-based construction firm Cardinal Infrastructure Group raised $241.5 million in its US initial public offering on December 9, 2025. The company sold 11.5 million shares at $21 each, hitting the midpoint of its $20 to $22 pricing range.

Key IPO Details

Cardinal Infrastructure priced shares at $21, valuing the firm at about $768.74 million fully diluted. Trading starts December 10, 2025, on Nasdaq under the ticker CDNL. Stifel and William Blair led as bookrunners, with D.A. Davidson as lead manager.

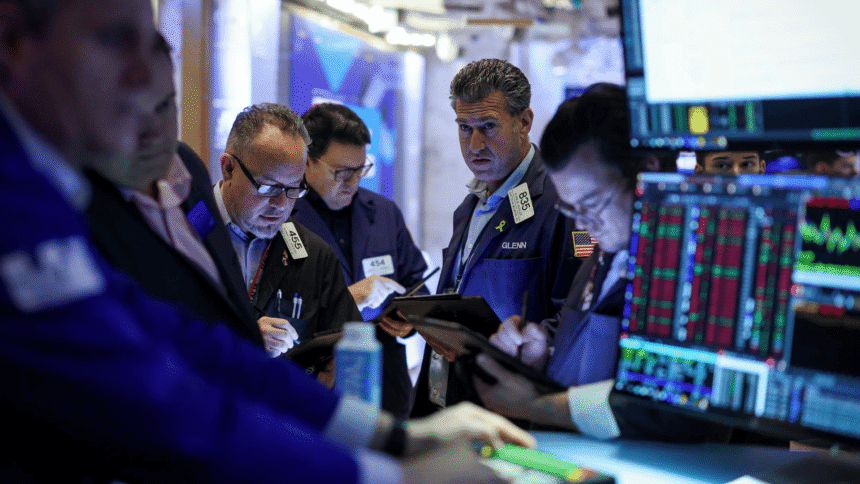

The IPO drew investor interest amid recovering market appetite post-AI sector sell-offs. Renaissance Capital strategist Matt Kennedy noted renewed risk tolerance for new listings.

Company Operations

Cardinal Infrastructure, founded in 2013 by CEO Jeremy Spivey, focuses on wet utility installations like water, sewer, and stormwater systems. It also handles grading, paving, and site development for residential, commercial, industrial, municipal, and state projects in North Carolina’s Raleigh, Charlotte, and Greensboro areas.

Leadership owns most of the firm, driving 27% growth via acquisitions since inception. As of September 30, 2025, backlog stood at $646 million across 100 projects.

Financial Performance

For the nine months ended September 30, 2025, Cardinal reported $310.2 million in revenue and $26.2 million in profit, up from $230.3 million in revenue and $21.9 million in profit in the prior year. Trailing 12-month revenue reached $395 million.

Market Context

Southeastern US infrastructure demand fuels Cardinal’s expansion. The firm positions itself as a key player in utility and site services amid rising construction needs.

This Cardinal Infrastructure IPO marks a strong debut for Raleigh construction stocks, boosting local sector visibility. Investors eye steady growth in wet utilities amid regional development.